Imagine you’re heading to the mailbox and you see the dreaded logo: the IRS wants to speak with you. There could be many reasons you’re getting a letter from the IRS, including that you owe a balance.

While there are other reasons that you may receive some IRS mail, it’s important not to panic.

Read on to find out exactly what you should do in the event that you receive an IRS certified letter.

If You Owe a Balance

One of the main reasons that you may get an IRS certified letter is if you owe a balance. Most of the time, you’ll be contacted via regular mail first, but a certified letter is sent if the IRS hasn’t heard back from you.

The first thing you should do is look at your options if you owe money to the IRS. In most cases, if you can’t afford the total balance, you can request to start a repayment plan.

Other options include making an offer in compromise. Either way, you should immediately respond to the letter instead of ignoring it, or else you could be subject to more interest and possible fines in the future.

IRS Certified Letter: Request for Information

In many cases, you’ll get a formal letter from the IRS when they need more information from you. This could be a discrepancy in your tax refund or perhaps they have some questions about your return.

When you get the certified letter from IRS, open it immediately without delay. It could be something as easy as needing to verify your identity rather than telling you that you owe them thousands of dollars.

Remember that certified mail is a formal letter, so it’s important to respond to any requests as soon as possible. Keep a copy of the letter you receive and respond to the IRS in writing so you have a paper trail.

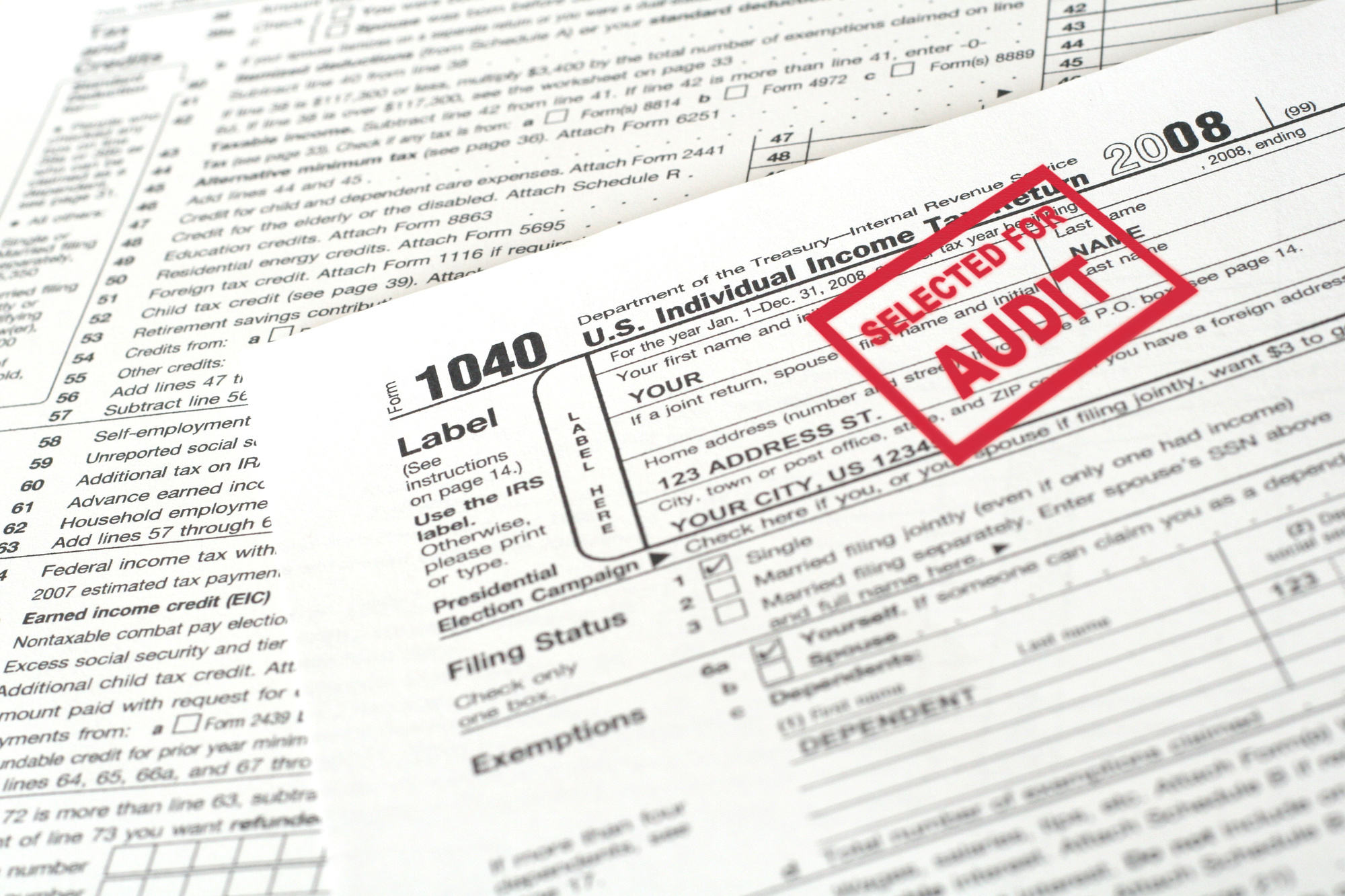

Audit Notice

Being audited by the IRS is every taxpayer’s nightmare. If you get any type of IRS communications, it’s vital that you read the information carefully,

Most IRS audit notices will include a list of steps that you need to follow. They will also include the deadline by which you need to respond.

If you get a notice that you’re going to be audited, don’t panic. The majority of IRS audits are done remotely via letters and paperwork, and they’re rarely done in person. No matter what, the key is to reply to any certified letter you receive as soon as you can.

Read Your IRS Mail Carefully

If you happen to receive an IRS certified letter, remember that it’s not the end of the world. Open the letter immediately, read the information carefully, and then contact the IRS with a response as soon as possible to avoid headaches later down the road.

For more great articles about business and finance, healthy living, and much more, check out my website today!

Leave a Reply

You must be logged in to post a comment.